Boosting Your Banking Business with Location-Based Marketing

This shift is happening in a highly competitive landscape where digital differentiation is increasingly challenging. Waiting for consumers to take the first step is no longer sustainable. Instead, financial institutions must harness available digital data to deliver highly personalised, geo-targeted services anticipating customer needs. Location-based marketing for businesses can significantly enhance visibility for branches and ATMs by targeting local customers with tailored promotions.

According to the Location-Based Marketing Association, location-based marketing can enhance in-store visits by up to 50% when personalised offers are employed

Location-based marketing (LBM) denotes the practice of targeting consumers with pertinent and personalised advertisements, discounts, and other incentives contingent upon their exact geographic location in real-time. This marketing strategy leverages mobile technology and GPS data to engage customers in more pertinent and timely manners, enhancing their brand experience. Integrating local SEO methods with location-based marketing enables businesses to efficiently enhance traffic to their branches and ATMs, hence augmenting client engagement.

As banks continue to embrace digital transformation, LBM plays a critical role in bridging the gap between online and offline customer interactions. By utilising LBM, banks can:

In social media marketing, Instagram and LinkedIn are effective channels for reaching diverse audiences. Banks can attract younger clientele on Instagram with its visual aspect. Banks may creatively promote their products and services using high-quality photographs and videos. Instagram Stories, polls, and Q&As get fans involved. Sharing educational content simplifies complex financial issues, and influencer collaborations increase reach and trustworthiness. Banks should post corporate finance papers and network and host webinars on LinkedIn to develop a professional image. LinkedIn advertising can attract corporate clients, and participating in relevant discussions can promote the bank as a thought leader.

Optimising your branches and ATMs with local SEO techniques is essential for attracting more nearby customers and enhancing their overall experience. By improving the local search ranking of your locations, you ensure they appear prominently when potential customers search for nearby banking services or ATMs. This enhanced exposure facilitates the attraction of more targeted traffic to your branches, as individuals nearby are more inclined to observe and frequent your locations.

Besides enhancing exposure, local SEO delivers essential information, such as operation hours, addresses, and contact data, thereby improving the user experience by facilitating client access to your services. Interacting with client evaluations and ensuring precise listings fosters confidence and promotes increased visitation, since favourable feedback and dependable information enhance the overall perception of your branches and ATMs.

Create a page on your website dedicated to the new branch. This page should include location photos, a clickable phone number, the branch address with Google Maps integration, opening hours, and branch manager information. This improves local SEO, improves client experience by providing all relevant information, and boosts branch ranking in local search results.

Claim and improve your Google My Business (GMB) profile with a branch description, precise contact information, high-quality photos, and a website connection. It improves your search engine rankings, promotes local presence on Google Search and Maps, and gives potential customers important information.

Intelligent Relation reports, 83% of customers start their search for banking products on Google, highlighting the importance of optimising for local SEO.

Implement tracking methods to measure the effectiveness of each marketing tactic. Use tools to analyse website traffic, ad performance, and engagement metrics. Tracking these efforts helps assess ROI, refine marketing strategies, and allocate resources more effectively for future campaigns.

Email marketing enables banks to communicate directly with clients. Personalised email marketing based on consumer behaviour and preferences boosts relevance and engagement. Segmenting the email list lets you send customised lending rates and financial advice. Automatic email campaigns based on consumer activities ensure timely and appropriate information. Welcome emails for new account holders, transactional confirmations, and lifecycle emails recognising account anniversaries or inactivity can improve customer connections and engagement.

Paid advertising is crucial for targeted outreach. Ads like Google Ads or Facebook ads allow banks to target specific keywords, placing ads in search results and on relevant websites to attract potential customers. Social media ads like Facebook can target users based on demographics and interests. Using diverse ad formats and retargeting strategies helps reach a wider audience and re-engage those interacting with the bank. These ads increase visibility among users actively searching for banking services and can also target competitors’ customers.

Banks must include mobile apps in their digital strategy due to the growing use of smartphones. Apps should be easy to use, tailored to user behaviour, and updated often to improve usefulness. Push notifications, unique discounts, and tailored financial insights can boost app usage and engagement. Maintaining a good user experience requires keeping the app appealing and relevant.

According to recent data, 90% of mobile time is spent on apps, and location-based notifications can boost app engagement by 20%. For banks, adding location-based features can significantly enhance customer interaction and satisfaction

Optimising the Internet banking experience is vital for customer satisfaction. The interface should be user-friendly and responsive across all devices, with simplified navigation for everyday banking tasks. Personalisation options, such as customisable dashboards, can enhance the user experience. Security is also a top priority; implementing robust authentication processes, advanced encryption, and continuous monitoring protects sensitive information and builds customer trust.

Video marketing effectively engages clients and simplifies challenging banking ideas. Banks can post instructive movies about their products and services, client testimonials, and behind-the-scenes footage on YouTube. Webinars can introduce new goods, provide financial education, and host expert panels, educating customers and engaging them.

Artificial Intelligence, particularly chatbots, is transforming customer service in banking. Chatbots answer routine questions and chores 24/7 and provide fast support. Analysing data and providing personalised recommendations and predicted insights can also personalise the user experience. AI-powered security systems detect and prevent fraud, providing safe banking.

Influencer marketing can efficiently reach and engage target audiences by working with individuals who align with the bank’s brand. Creating content with influencers that naturally combines the bank’s services boosts authenticity and relatability. Long-term partnerships with influencers help sustain engagement while diversifying the portfolio and expanding reach. Analytics help banks track influencer campaigns and assure marketing success.

Smart Insights reports that 71% of marketers consider influencer marketing to be highly effective for boosting brand awareness and engagement.

Compose blog posts and articles regarding the new branch, elucidating the services provided, advantages to the community, and any exclusive promotions. Integrating high-quality movies can significantly augment engagement.

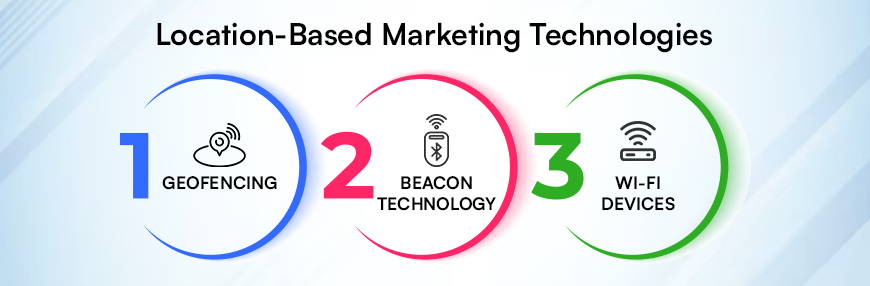

Now let’s explore how you can unlock the potential of your banking business with cutting-edge location-based marketing technologies.

Geofencing is a very proactive location-based marketing strategy. It helps organisations utilise geolocation data that engages users inside a specific or defined geographic region. It gives customised content as per a user’s real-time or current location or during former visits. In banking, geofencing offers vast potential, from enhancing fraud detection to improving customer service, by delivering relevant offers and information in real-time as customers move through or near key locations.

Beacon technology takes location-based marketing up a notch. These tiny Bluetooth devices connect with nearby smartphones to create personalised, location-based experiences. For banks, it means recognizing customers the moment they walk into a branch and instantly pulling up their data to offer tailored services and deals in real-time during their visit. Additionally, beacons can deliver personalised and targeted content directly to a customer’s mobile device, enhancing the in-branch experience.

Wi-Fi technology can also activate proximity notifications, contributing to location-based marketing. Banks can monitor when clients join or leave a Wi-Fi zone without the need for supplementary hardware and react with relevant digital material using a mobile app. In order to provide a more engaging and efficient customer experience, this method uses the existing Wi-Fi infrastructure to offer personalised information.

IndusInd Bank encountered following difficulties with:

Vicinus executed hyperlocal marketing services through a strategic relationship that covered:

Through its collaboration with Vicinus, IndusInd Bank has enhanced its online visibility and continues to prosper in a competitive landscape with increased discoverability and heightened client interaction.

Bank of America adopted location-based marketing by utilising beacon technology in several branches. When two people are within a particular distance of one another, beacons are small wireless devices that deliver notifications to the smartphones of those individuals. In order to improve the overall quality of the customer experience, numerous companies made use of this technology. They did this by providing customers who visited their branches with information that was not only timely but also customised.

When a consumer visits a branch, the beacon will activate a push notification on their phone, providing them with pertinent services like mortgage rates, loan approvals, or investment choices. In addition, the bank could dispatch notifications on impending appointments or propose adjacent ATM locations for convenience. The high degree of customization fostered a stronger sense of connection and knowledge among customers, resulting in a substantial increase in mobile app usage and customer contentment.

Enhanced App Utilisation

Following the implementation of the beacon strategy, Bank of America experienced a notable 30% surge in mobile app engagement. This was attributed to users actively availing personalised services and offers.

The bank enhanced its in-branch client experience by decreasing waiting periods and optimising services according to customer preferences, which are conveniently supplied on their smartphones.

Bank of America observed a significant rise in product inquiries and conversions by providing customised incentives such as personalised loan offers or credit cards.

By utilising location-based marketing strategies, banks may forge stronger and more personalised connections with their clients. By leveraging technology such as geofencing, beacon sensors, and Wi-Fi notifications, banks may provide customers with personalised content and offers that are based on their current location and previous actions. By delivering timely promotions and relevant information, these techniques improve the customer experience and increase engagement, stimulate foot traffic to physical branches, and more. Incorporating these cutting-edge location-based strategies allows banks to outperform the competition, strengthen client connections, and maximise marketing efforts in a dynamic business.

Marketing in banking is used to build brand awareness, attract customers, and retain them. Banks utilise digital ads, content marketing, SEO, social media, and email campaigns to promote services and reach targeted audiences effectively.

You can attract more customers by optimising your Google My Business profile, running geo-targeted ads, and creating local content that resonates with the community. Hosting and promoting local events on social media can also increase foot traffic to your branches.

Geo-targeted advertising involves displaying ads to users based on their geographic location. For banks, this allows you to target individuals near your branches or in areas where you want to expand your market presence, ultimately driving higher foot traffic and attracting more local customers.